The Agentic Finance Landscape Report: Q3 2025 Edition

Written in collaboration with Cambrian teammates Ariel, Brian, Doug, Jason, Pili, Ricky, and Tumay.

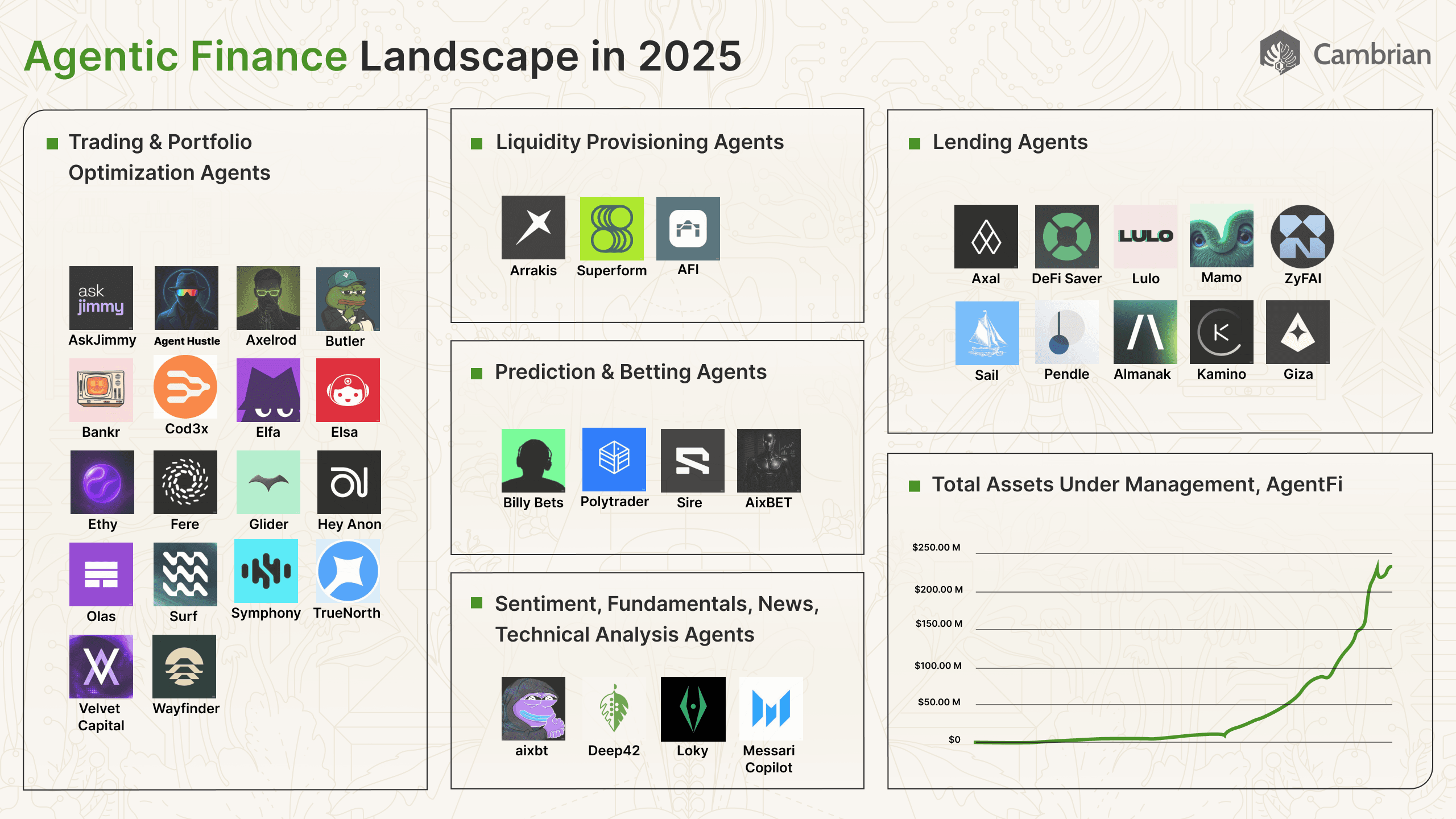

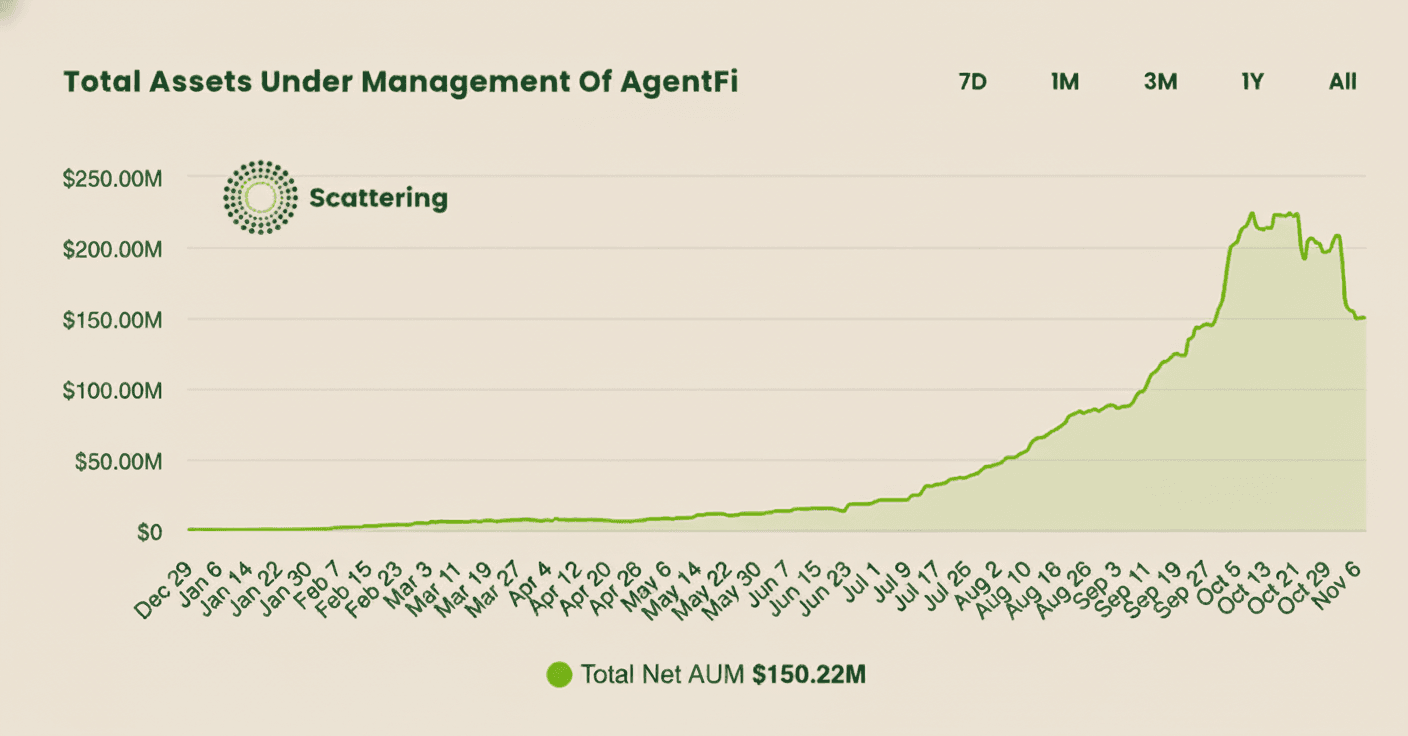

Since the first edition of The Agentic Finance Landscape was published, the AgentFi market segment has evolved from promising demos, with almost no assets under management, to systems running in production and managing hundreds of millions of dollars. Dozens of autonomous products now trade, rebalance portfolios, provision liquidity, lend, and settle with real capital at stake.

New rails are making this practical at scale: wallet-native, per-request payments via x402, and broader industry work on standardized agent payments (AP2) and trust layers for on-chain agents (ERC-8004). Together, they streamline the work involved in connecting, paying, and verifying agents' actions.

This second edition surveys the landscape from the perspective of autonomous products that support retail participants in decentralized finance (DeFi). As before, we applied a strict bar: active projects available to the public, with real users or live capital at work. We categorize agents by product type.

Jump down to learn more about each depicted project.

Table of Contents

- What is Agentic Finance?

- Autonomy vs. Intelligence in Agentic Finance

- AgentFi Market Growth in 2025

- The Agentic Finance Landscape Q3 2025

- What’s next for Agentic Finance?

What is Agentic Finance?

Agentic finance is an emerging market segment of products that use automation to actively manage user funds or provide financial advice. Inspired by ChatGPT and similar AI tools, some of these products utilize LLMs, while others employ hard-coded rules or traditional machine learning. Regardless of the underlying tech, many of them describe themselves as “agentic.”

Trading bots were the original AgentFi products, and they still have strong product-market fit. For example, trading bots account for over half the trades on Solana today¹. In addition, DEX volume from trading bots spiked on major chains during October 2025². The agentic products covered in this report can be viewed as the next (big) step in sophistication from trading bots.

Retail users are the early adopters of AgentFi. In the very near future, traders, treasury managers, financial analysts, research analysts, and all other financial professionals will utilize specialized agentic finance products to accelerate their work, reduce risks, and ultimately be more profitable.

Autonomy vs. Intelligence in Agentic Finance

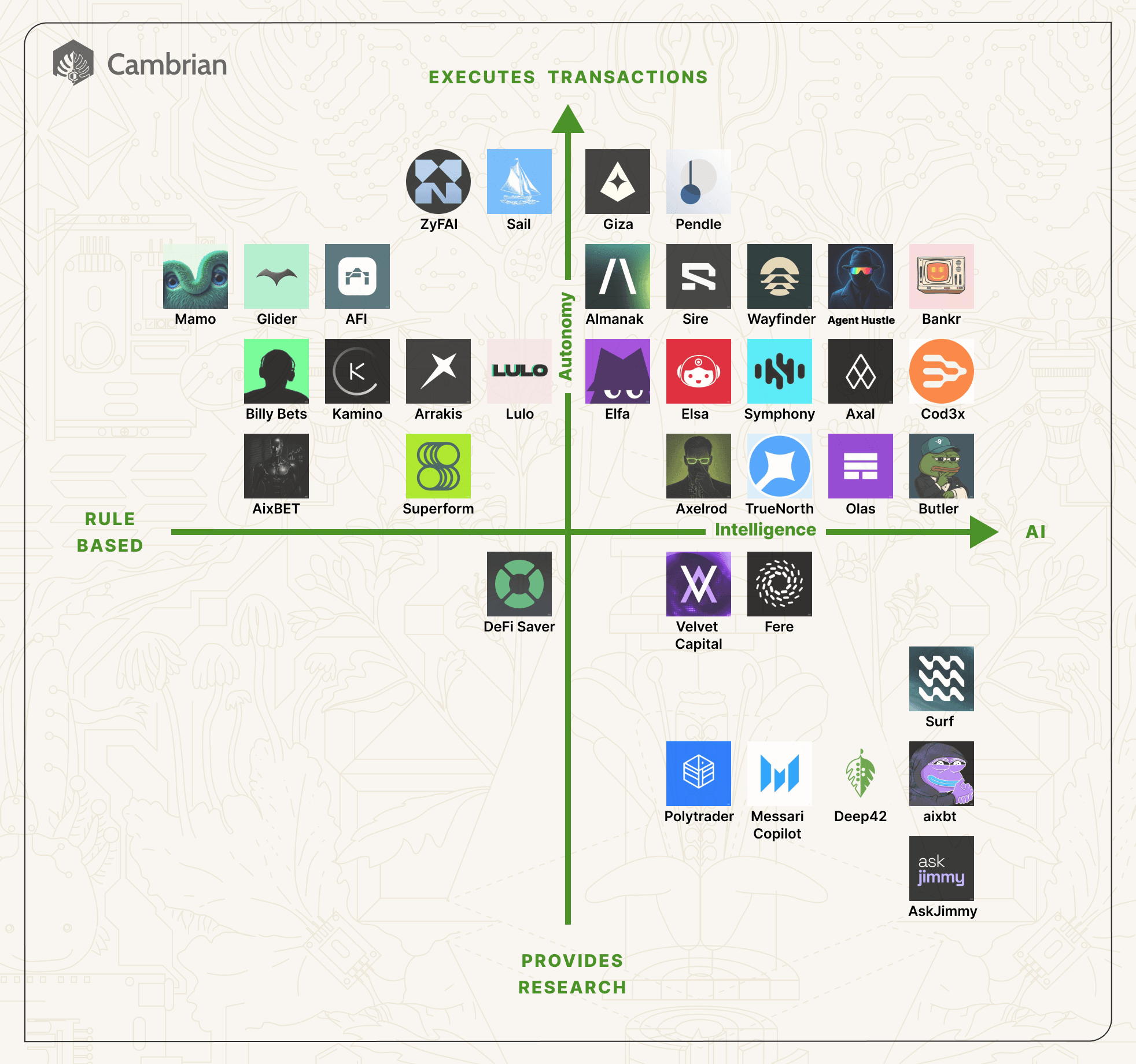

As mentioned in our previous report, agentic finance projects span specialized use cases, but each project can be placed on a simple compass. On the x-axis is intelligence: on the left, rule-based systems that rely on math and statistics; on the right, LLM-based systems (what many now call “AI agents”). The y-axis represents autonomy, ranging from tools that inform at the bottom, to human-in-the-loop systems in the middle, to autonomous systems that execute within policy without requiring permission at the top.

Since the first edition of this report, the center of gravity has shifted upward toward greater autonomy, while products with the most assets under management remain on the rule-based side of capital allocation decisions. LLMs are demonstrating their strengths in areas such as interface, information retrieval, and analysis. But when money moves, algorithmic agents remain the norm for reliability and auditability.

AgentFi Market Growth in 2025

Growth Metrics

Since our last report, the ecosystem has expanded on every front. It’s now evident that agents need economic participation to be useful at scale. Production-ready projects are emerging, use-case coverage is increasing, and AgentFi assets under management climbed from near zero at the beginning of 2025 to over $200m in October.

Source: https://scattering.io/agent_store/aum

Emerging Trends

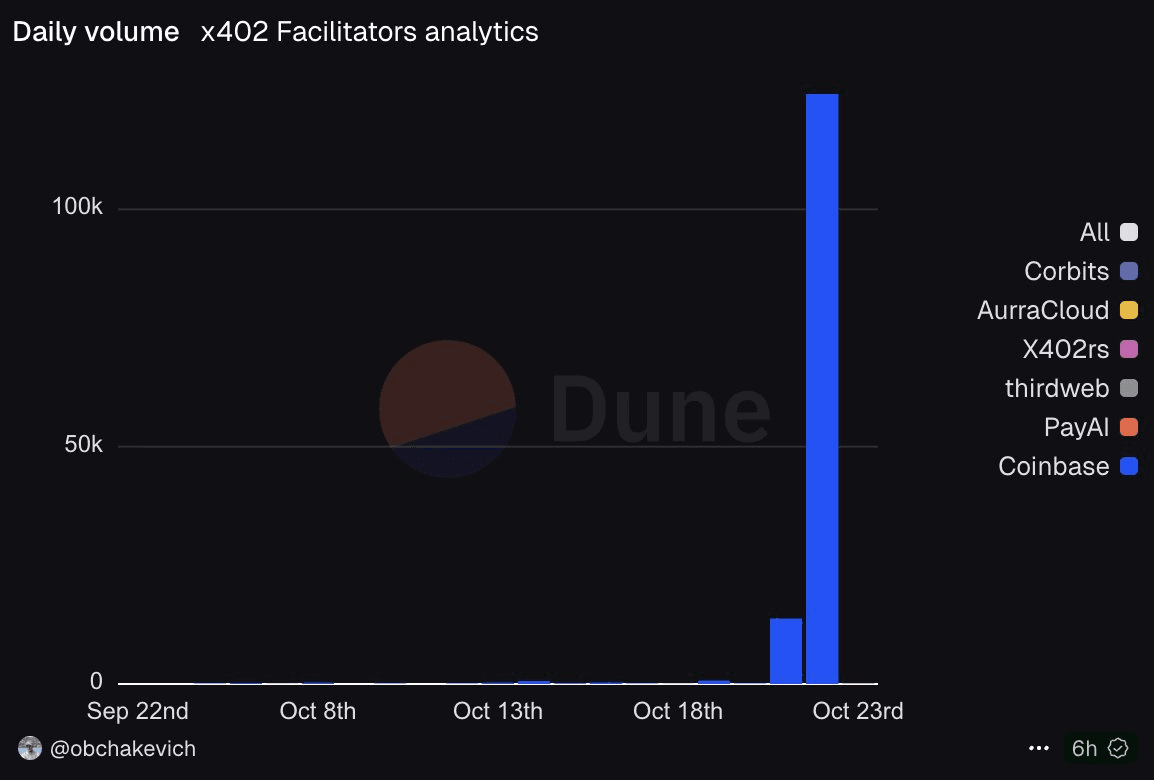

The momentum in AgentFi corresponds with other recent agentic developments within crypto. Converging standards for agent payments (x402) and agent coordination (ERC-8004) are making integrations more straightforward. The new Coinbase-initiated payment protocol x402 provides teams with crypto-native micropayments. x402 initially launched on Base, with subsequent adoption by Solana and Polygon. At the same time, Ethereum’s ERC-8004 standardizes shared registries for agent identity, reputation, and validation, allowing teams to ship faster, focus on core agent functionality, and drive interoperability.

x402 agent-payments went near-vertical in late October: public dashboards show around 500k transactions in a single week (October 14th to 20th), a nearly 11,000% jump versus four weeks prior, with subsequent weeks clearing more than 900k transactions and cumulative volume exceeding $2m³. Looking ahead, Gartner estimates that by 2030, agents will make or influence approximately $30 trillion in purchases⁴.

Source: https://dune.com/obchakevich/x402

Interoperability has not yet happened across the products listed in this report - they were all created before x402 and ERC-8004 were created. The products listed here all create their own agents and directly interact with existing DeFi protocols, but not with other agents.

To get widespread agentic adoption in crypto, work is needed beyond x402 and ERC-8004. Consider the challenge of an agent that wants to interact across multiple protocols. To do that today requires the agent developer to study different protocol SDKs and to learn how to create and execute transactions within each protocol. For example, there are now many lending protocols, each with constantly changing smart contract (EVM) or program (Solana) interfaces. Some teams, like Compass Labs, are providing API based abstractions for that problem. And Solana has launched an ambitious interoperability effort, Solana Bench, which includes context engineering and fine-tuning LLMs to help developers and agents quickly learn to use the leading Solana programs; I expect to see other leading chains launch similar efforts.

The Agentic Finance Landscape Q3 2025

Retail users are the early adopters of agentic finance, while institutions are paying attention but don’t seem close to adoption. The typical institutional path is cautious, starting with research, then moving to small, policy-bounded allocations, and keeping a human in the loop for approvals. Below, we list the most legitimate retail-oriented AgentFi products.

We don’t list projects still in development or in internal testing, as well as those that use only an LLM interface but require humans to make the “hard” decisions. This ruled out many projects.

Trading and Portfolio Optimization Agents

Trading agents are the first product most people think of when they hear “agentic finance.” These agents manage users' funds by rebalancing portfolios or picking assets to buy or sell. Decision-making in trading requires access to an exchange, assets to trade, a budget, trading guidelines or rules, and high-quality data. The agentic tools below provide support for one or more of these aspects.

Liquidity Provisioning Agents

Decentralized exchanges (DEXs) rely on third-party liquidity providers (LPs) to provide liquidity for token pairs that traders use to swap. Traders pay fees on each trade, which accrue to LPs. Several factors determine LP profitability, including impermanent loss, trading volume, and fee tiers, plus protocol incentives. The following agents help LPs decide where they can earn the most fees by providing liquidity.

Lending Agents

Lending in crypto is a way to earn yield by supplying assets that borrowers draw against collateral. When deciding whether and when to deposit crypto into a lending protocol, lending agents must consider a combination of yield, risk, and opportunity cost factors.

Prediction and Betting Agents

Prediction markets are platforms where users can bet on the outcomes of future events, such as election results or sports competitions. These markets often require tracking news and other real-world information that can unfold and change in unexpected ways in real-time. Prediction markets are an ideal fit for agentic participants, as outlined in this blog post by Vitalik Buterin on information finance (InfoFi).

Sentiment, Fundamentals, News, Technical Analysis Agents

Investors often use market analysis to determine what to buy and sentiment analysis to decide when to buy or sell. LLMs have significantly transformed both market and sentiment analysis by scaling the amount of data analyzed, the speed at which it is analyzed, and creating a deeper contextual understanding by identifying connections between data sources. A distinguishing feature of analysis agents and the agents above is that they do not take direct actions; instead, they provide informative guidance. There are many analysis agents; we only list a few below.

It is worth noting that the agentic finance landscape is evolving rapidly, and existing projects are expanding into new domains. For example, even if a project is currently listed only in the lending category, we could expect it to branch into liquidity provisioning tomorrow.

What’s next for agentic finance?

The crypto industry spent this year laying the rails for traditional capital to move onchain. In 2025, the total crypto market cap surpassed $4 trillion. Traditional firms are now shipping real products: blue-chip banks (JPM, Citi, HSBC) are using tokenized deposits and RWAs; asset managers (BlackRock, Fidelity, Franklin, UBS) are launching ETFs and tokenized funds; and payments/commerce (PayPal, Stripe, Visa, Mastercard, Shopify) are normalizing stablecoin rails while consumer platforms like Robinhood bring tokenized equities to mainstream investors.

The regulatory landscape is also playing a significant role in reducing friction and providing clarity for crypto adoption. To mention a few examples, stablecoin payments are getting a clear path in the UK; the ETF pipeline has been unblocked in the US with the SEC approving generic listing standards for spot-commodity ETPs; Hong Kong is getting friendlier trading rules and moving forward with stablecoin licensing; MiCA Level-2 is marching on in the EU.

Agentic finance is an emerging market segment with promising growth predictions. The rails and demand are no longer hypothetical. In October 2025, DEX volume hit an all-time high of $613.3B, while perp-DEXs cleared about $1.3T. Stablecoin supply pushed past $300B, and tokenized Treasuries climbed to roughly $5.5B, while BlackRock’s spot bitcoin ETF neared $100B AUM, signaling institutional appetite. Taken together, the direction is clear: more capital onchain, clearer standards, and agents moving from analysis to policy-bound execution.

Many of the tools in this report are the first of their kind in both traditional and decentralized finance. We expect some of them to fall short of their promise, but we’re confident that the broader agentic finance landscape will continue to mature. Eventually, everyone will use agents; they will gain users’ trust, become major economic actors, and occupy most of the blockchain space. Those who begin their agentic finance journey early will reap rewards later.

Additionally, as developers earn users’ trust by delivering consistent risk-adjusted returns, the center of gravity will shift from how strategies work to whether they meet policy-bound outcomes. Meanwhile, strategies will grow more intricate while the user experience gets simpler. We expect to see significant UX improvements as the agentic finance landscape continues to evolve and tools enter a production-readiness stage.

We may cover adjacent topics in future posts. Including agent-to-agent (A2A) communication and payments, evolving standards (x402/AP2 for payments, and ERC-8004 for identity/reputation/validation), agent infrastructure and open-source frameworks, data infrastructure and indexers, onchain identity, agent launchpads/ marketplaces and revenue-sharing, privacy and verifiability, evaluation benchmarks, and modeling and simulation. To stay ahead of the agentic finance curve:

- Sign up for the Cambrian newsletter to be notified of our next post.

- Join the Cambrian Discord to stay up to date with Cambrian news.

- If you’re a developer building agentic applications, register for the Cambrian API limited-access advanced release cohort.

Lastly, connect with me on X to share your ideas or to let me know if I’ve missed anything in the first edition of the agentic finance landscape.

About the author

Sam Green is the founder of Cambrian Network, the financial intelligence layer for agents. Prior to Cambrian, Sam contributed to Semiotic Labs as co-founder and CTO, leading AI and verifiability efforts for The Graph. Sam also helped develop Odos, a leading crypto trading platform that has handled $100 billion in trading volume for 3 million users. Previously, Sam was an AI and cryptography researcher at Sandia National Labs. Sam holds a master's degree in applied mathematics and earned a Ph.D. in computer science at UC Santa Barbara.

About Cambrian

Cambrian is the financial intelligence layer for agents. Cambrian’s API provides real-time and historical blockchain data for agentic DeFi applications. We're focused on providing verifiable financial insights, including yield, liquidity positions, risk, whale activity, and market sentiment.

This content is for general information only and does not constitute financial, investment, legal, or tax advice. Accuracy is believed reliable at the time of publication, but is not guaranteed, and opinions may change without notice. You should conduct your own research and consult qualified professionals before making decisions. References to third‑party projects do not imply endorsement. The author and publisher accept no liability for any loss or damage arising from reliance on this material.

Sources:

¹ https://www.helius.dev/blog/solana-ecosystem-report-h1-2025

² https://dune.com/whale_hunter/dex-trading-bot-wars

³ https://x.com/Base_Insights/status/1983360641172914545

⁴ https://www.forbes.com/sites/torconstantino/2025/02/18/machine-customers-ai-buyers-to-control-30-trillion-in-purchases-by-2030/